Previous

Next

Previous

Next

Clients

Previous

Next

Why Choose Us

Experienced Team

Our vastly experienced team will build solutions matching to your business needs.

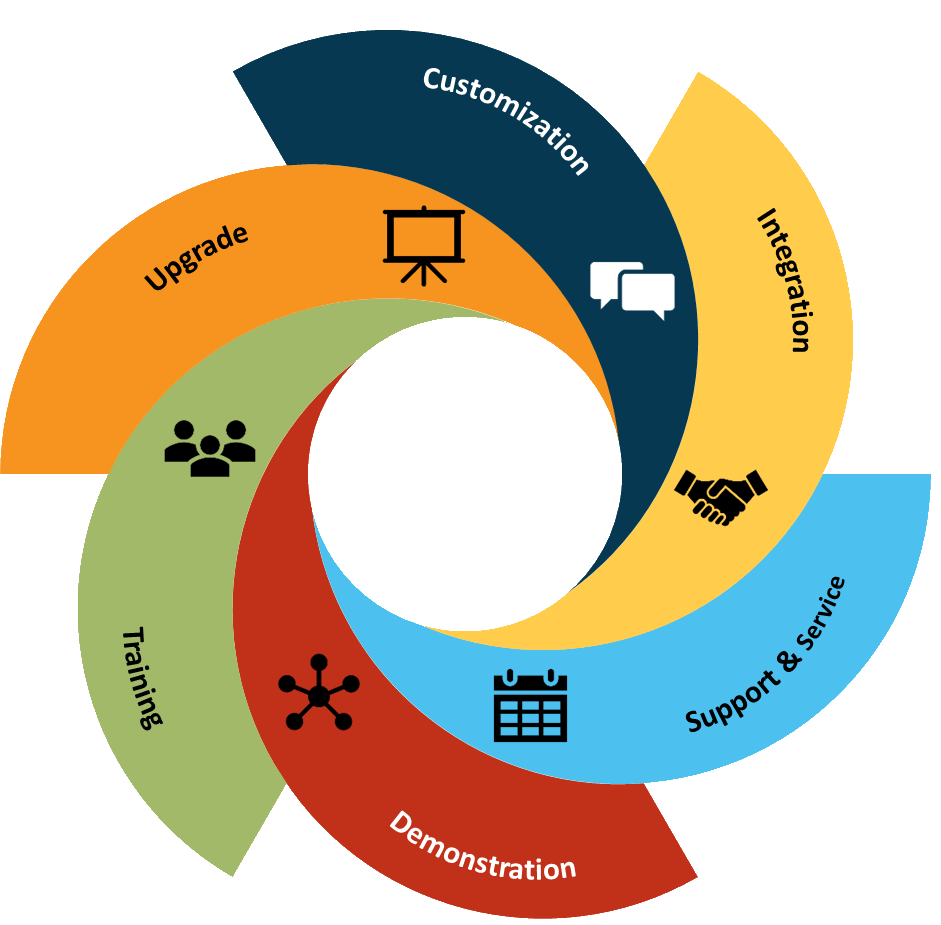

Detailed Solutions

Your interests always comes first and this helps our team build great business solutions.

World Class Service

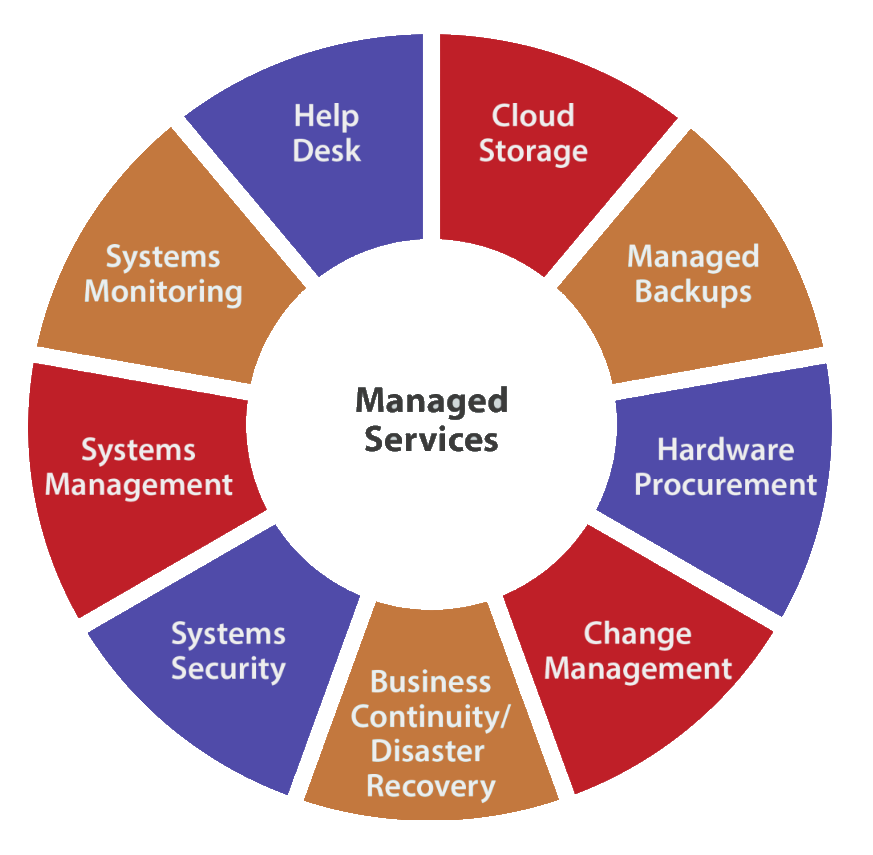

We always strive to provide world class service and it shows in our products and services.